What You Should Know About Pre-Foreclosure

July 7, 2020

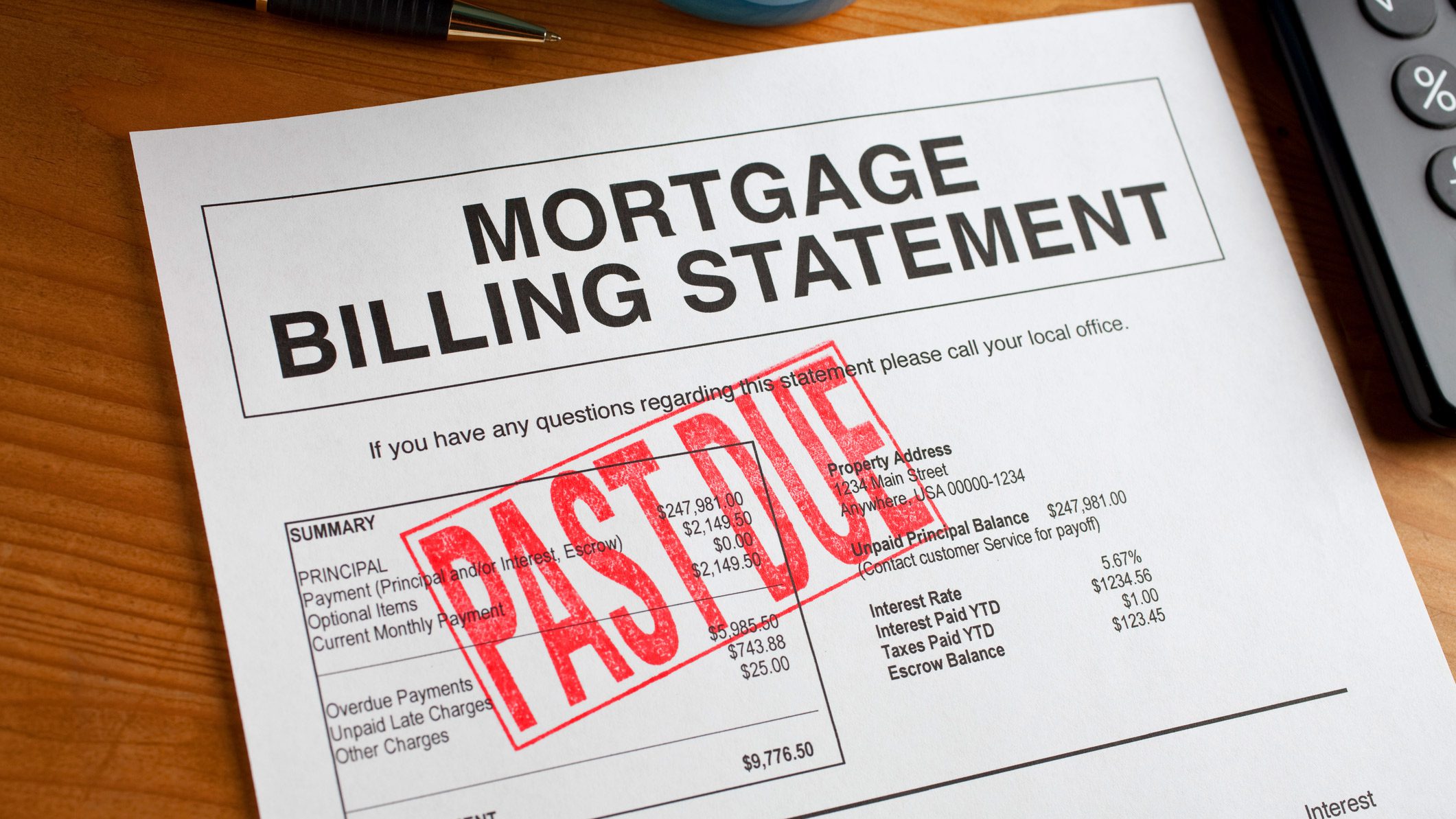

The word foreclosure is scary to any homeowner. You know that it’s the legal process in which a lender attempts to recover the loan from a borrower who has stopped making payments. In most cases, they force this by selling the asset used as the collateral for the loan. Yet, not as many homeowners are familiar with the term pre-foreclosure, which is the first step in the foreclosure process. Here’s what you should know.

What is pre-foreclosure?

Pre-foreclosure notifies homeowners that their property is in danger of getting repossessed. You’ll be notified of pre-foreclosure with a default notice from your lender. This notice is typically sent after you fall two to three months behind on your mortgage payments, and it will let you know that the foreclosure process will begin if your debt is not paid on time.

The period of pre-foreclosure is the time after your lender has notified you that your home will foreclose if you do not make payments but before the process is complete and your lender has taken possession of your home.

In simpler terms, pre-foreclosure should be regarded as your “final warning.”

What can you do to avoid pre-foreclosure?

- Loan modification: If you’re struggling to pay your monthly mortgage, you can request that your lender extends the length of your loan. This means you’ll be responsible for paying less each month. Depending on their flexibility, your lender may also lower the interest rate or allow you to add your missed payment to the end of your loan. This is a better solution for all involved than a foreclosure.

- Deed in lieu of foreclosure: This occurs when homeowners who are behind on their mortgage give their house’s deed to the bank to settle their debt. Then, they leave the house, pre-foreclosure ends, and the home never reaches official foreclosure. The lender must agree to this before it happens.

- Short sale: In this scenario, the homeowner would sell their house to settle their bills with the lender. Before doing so, the homeowner would need to talk to their lender about selling their home. The bank would get all the money from the sale. In this case, pre-foreclosure would end, and the bank wouldn’t have to foreclose the house. You’d walk away from the situation with no bills – although, you’d also have no house as well.

Does pre-foreclosure impact your credit?

When a foreclosure occurs, your credit is affected drastically. Does pre-foreclosure have the same impact? The short answer is yes. Credit scores are based on whether you make payments on time or not. If you’ve already reached pre-foreclosure, then the bank is recording your late payments, which will affect your credit score.

In the future, it will be harder to get loans because lenders will see that behavior. However, if you can pull your home out of foreclosure before the bank repossesses it, then your credit will be salvaged to some extent. A home officially enters foreclosure if no mortgage payment or other deal can be made during the pre-foreclosure period. RE:Vitalize Properties may be able to help you save your credit and get into a better situation.